The PEST (Political, Economic, Socio-Cultural, Technological) Analysis was developed by Francis Aguilar and primarily used in strategic business planning. It addresses macro concerns which could possibly affect a business’ future detrimentally or positively. At the very least, they provide an acute understanding of the business environment an organisation operates in. This allows familiar threats and to be tackled and identifies promising trends to jump on for a ride.

Political

East-West Bridge

Though the world is increasingly globalised, the east-west divide does not fade away. Trust companies that operate internationally will continue to bridge this divide and facilitate cross-cultural business partnerships. This gives them value beyond merely corporate and fiduciary services.

Volatile Political Climate

Global politics play a huge role in today’s business world with strongmen politicians at the helm of large countries. On the whole, they have played the nationalistic card and stoked xenophobic sentiments. This has created a toxic environment which inevitably lead to trade wars. With new trade regulations rolling out time and again, international business operations are the first to get affected. This includes the changing laws and regulations to offshore tax havens, which is embedded in the fiduciary business. Hence, there is a need to monitor the capricious political global climate and its ever-changing regulations.

Economic

Economic Slowdown

The recent years have seen an economic slowdown, further worsened by the Covid-19 pandemic. With the world headed for a recession, economic uncertainty results in many companies and individuals tightening their belts. Thus, price as a factor in corporate procurement decisions is an increasing concern. Corporate service alternatives which are cheaper will appear more attractive to prospective clients. As such, fiduciary businesses need to distinguish and differentiate themselves from their competitors to convey a value-added brand promise that justifies prospects choosing a pricier option.

Social-Cultural

Covid-19 Pandemic

The unprecedented repercussions of the Covid-19 pandemic have forced most of the world’s workforce to work from home, while travel restrictions affect many businesses that are expanding overseas or already have multiple offices in different locations. Undoubtedly, the cross-border and cross-jurisdiction nature of the trust industry is heavily affected by this pandemic.

Unfavourable Impressions of Tax Havens

A negative impression of the fiduciary business is its associations with tax havens and its perception of being used to avoid taxes which could be better used for social welfare and government spending. This is further exacerbated by the secretive nature of trust companies required to guarantee their clients’ anonymity. In 2017, the European Union adopted a tax haven blacklist aimed at tackling external risks of tax abuse and unfair tax competition. As of 27 February 2020, the most recent revision has 12 non-cooperative jurisdictions on the blacklist.

Technological

Fintech Developments

Developments in technology are a key consideration for most corporate services providers and fiduciary businesses. In this fintech era, clients from financial institutions will face disruption for both good and worse. To strategically stand beside them in these disruptive times will potentially strengthen long-term business relations.

Cybersecurity

Admittedly, most fiduciary businesses are a prime target for cyberattacks due to the nature of fiduciary work with corporate clients and High Net Worth Individuals (HNWIs). Across the board, stringent internal audits are vital to ensure that potential security risks are mitigated.

A Case Study: Equiom Group

Profile

Founded in 1978, Equiom Group (Equiom) sees itself as a global professional services provider offering a range of innovative and effective business partnering solutions. Equiom supports corporations and HWNIs around the world with their fiduciary and related support-service needs. Their tagline ‘Guiding You Forward’ communicates a brand promise of working with their clients to navigate the twists and turns on their journey towards achieving their ambitions. This is also articulated in their visual brand expression of an idyllic road from a bird’s eye view. This is consistently repeated throughout its online channels such as Facebook and LinkedIn.

Service Offerings

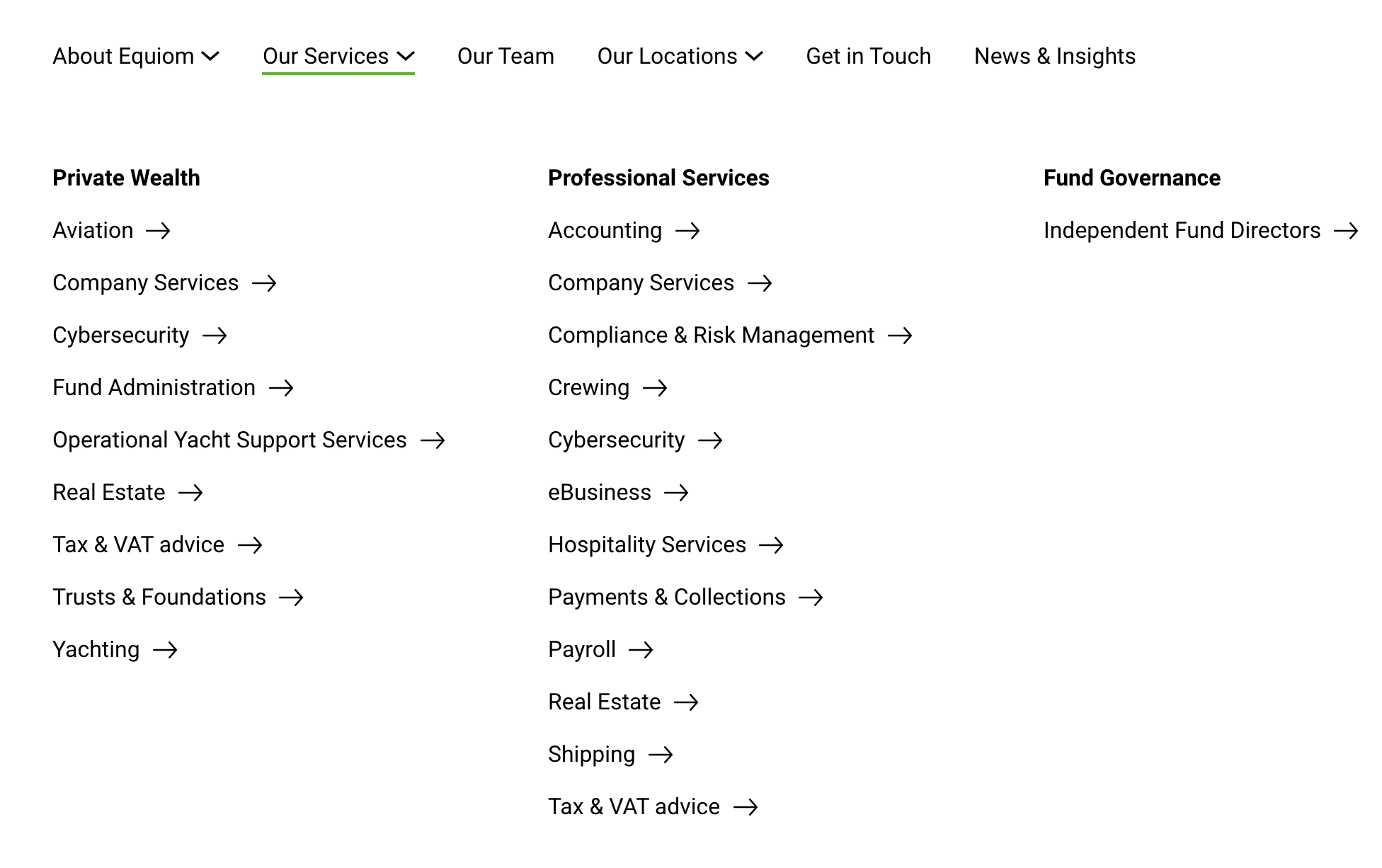

Visibly, its service offerings listed in the drop-down menu of its main site are categorised into a column each for private clients and corporate clients, with a third column for funds. In addition to the often-seen service offerings, Equiom includes yachting and aviation under the “private clients” column, where specialised asset management for prestigious superyachts and aircraft ownership implies a clientele with deep pockets.

Key Takeaways

A vital approach in terms of branding is to own a visual brand expression like how Equiom has done. This distinguishes it from other brands that predominantly rely on their logo and corporate colours in their digital touchpoints.

A visually compelling website which doubles as a lead generation platform is key to steady business growth, as it is the first online face of the company (followed by its social media platforms).

The clear presentation of service offerings, accompanied with other related services, gives prospective clients a better sense of other services that Equiom provides. Such a feature should not be underestimated, as the corporate services sector involves the long-term relationship between client and services provider. With a broad range of service offerings, the client’s needs can often be met without them considering a change of corporate service provider.