Cryptocurrencies. Just bring it up in any conversation and you can easily tell who are its bullish promoters and skeptical detractors. In the first camp, you have those who believe cryptocurrencies to be the next big leap in decentralised finance, overhauling the monetary system as we know it. In the other camp, you have those who brush it off as no more than another bubble, and a medium of exchange for shady business. Someone even went as far as referring to cryptocurrencies as “disgusting and contrary to the interests of civilisation”. Ouch. Like it or not, cryptocurrencies have exploded in popularity, a leap from its early days in 2008.

Bitcoin (BTC) » Digital Gold & Market Leader

Speaking of 2008…that’s when Bitcoin was created by an ‘anonymous’ Satoshi Nakamoto. Oxymoronic, I know. Nobody even knows who this person is. It could be a pseudonym for a group of high-tech folks who envisioned the future of money. Or it could be your next door neighbour whom you thought was a tech dinosaur.

Essentially, Bitcoin was the first. Its double-striped B logo has become synonymous with the world of cryptocurrency, almost always the face of cryptocurrency itself. Though unintentional, the B in Bitcoin represents the blockchain technology that made it possible. A blockchain is essentially a public decentralised ledger on the network, consisting of small little blocks of transaction records. Once each block is filled up, it is chained to the previous block in chronological order…thus forming a blockchain. The ledger is decentralised, meaning to say it does not require a central authority such as a central bank or financial institution to facilitate transactions.

When people think of Bitcoin, they do not necessarily think of the blockchain technology it runs on. Instead, our minds are wired to put an instant image to a concept that is new and somewhat unknown. As the first cryptocurrency in the game, Bitcoin is aptly named as such with the word ‘coin’ as part of its name. Thus the image of a double-striped B derived from the $ sign we know combined with a circular icon of a coin commits the image to memory. Add the striking orange, and you have the iconic Bitcoin brand identity, standing out in the blue and red oceans (IYKYK) of banks and financial institutions,.

Cryptocurrencies are an antithesis to the conventional monetary system operated by a central authority, the government. Fundamentally, they are decentralised and require no third party or authority to back it. This is pretty far off from a coin, a round piece of metal that comes from the mint, owned by the government. Though one could say the coin in Bitcoin is used in a figurative sense, the problem lies with having an identifier as part of its name, much like a brand name that restricts itself to a category or industry vertical. Think GrabTaxi. It restricts the startup as a ride-hailing service, if not for their 2016 rebrand to “Grab”. Without which, we’d still be saying things like “GrabTaxi pay for that GrabTaxi food to get all the GrabTaxi rewards”. Bitcoin’s runaway success is also its Achilles’ heel.

Ethereum (ETH) » Digital Silver & Smart Contracts

After Bitcoin, Ethereum is the 2nd largest cryptocurrency by market capitalisation. It was crowdfund-developed by Vitalik Buterin back in 2014 and went live on the network in 2015. On the technical side, it’s a 2nd generation cryptocurrency, more commonly known as Blockchain 2.0. This represents significant improvements from the 1st generation with its use of smart contracts. Smart contracts are self-executing contracts based on blockchain technology. For instance, if one party defaults on a loan, the smart contract will execute the pre-written agreement of forfeiting said party’s deposit. This negates the need for any intermediaries to do the forfeiture.

Think of all the conventional paper contracts we have today. Smart contracts are about to overhaul everything. This will shake up the financial services and legal industry that operate on contracts and the nature of trust. Anything that involves contracts—financial derivatives, insurance, fiduciary, escrow in financial services to legal processes and agreements, such as property, conveyance and employment law—are about to change.

How Ethereum got its name was from the geeky Vitalik who was inspired by science fiction literature he read as a child. The root word, Ether, is an invisible hypothetical medium which covers the entire universe and allows light to pass through it. Ethereum’s logo, a stylised diamond, represents one of the most stable and strongest materials in nature. Here, we can even draw a reference to diamond hands, an investment term popularised by Reddit’s wallstreetbets to describe the fortitude of unwavering investors to hold a financial position even with bearish performance.

Ethereum’s Hero Illustration by Liam Cobb

It would not be a stretch to say that even as a brand, Ethereum is decentralised. Its brand assets are the work of not one artist, but many. On the Ethereum website, the main page illustration is by Liam Cobb. Whereas, other brand imagery used throughout the site are the works of other artists—William Tempest, Viktor Hachmang, Patrick Atkins, EthWorks & Alan Wu.

These illustrations are in utopian futuristic settings full of holograms everywhere. By adopting a similar colour palette, it forms a cohesive brand consistency when applied on the Ethereum website. The brand assets are also openly available to download and use for those working on Ethereum-based projects.

These illustrations are in utopian futuristic settings full of holograms everywhere. By adopting a similar colour palette, it forms a cohesive brand consistency when applied on the Ethereum website. The brand assets are also openly available to download and use for those working on Ethereum-based projects.

Unlike Bitcoin, Ethereum does not have the word ‘coin’ in its name. Befittingly so, because the Ethereum platform is not just a cryptocurrency, but a digital ecosystem used as a basis for other projects. Today, there are numerous projects and decentralised applications (dApps) that are based on the Ethereum blockchain. Blockchain 2.0 also pushes the envelope of the DeFi (Decentralised Finance) space and developers can create newer cryptocurrencies with their own branding and strategic vision to change the world.

Dogecoin (DOGE) » Memecoin Rally to the Moon?

Really…Dogecoin? Having this cryptocurrency in this article is a joke. I can barely call it an investment with a straight face. What can we even learn from it?

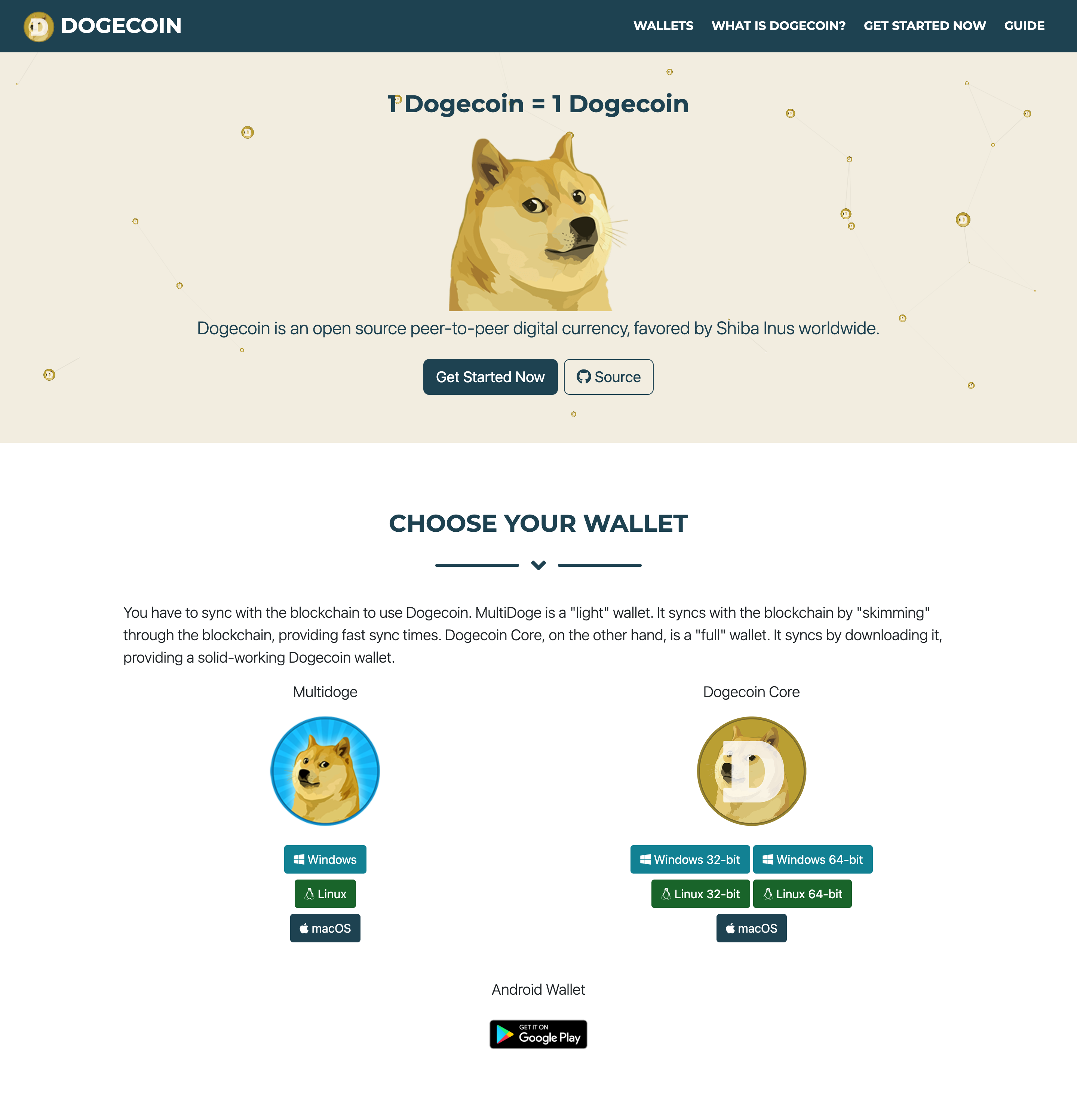

Dogecoin hommepage sez 1 Dogecoin = 1 Dogecoiny

A lot, in fact. For starters, it really started as a joke back in 2013. It was created by software engineers Billy Markus and Jackson Palmer, who created the payment system to poke fun at the wild crypto-speculation back then. Dogecoin appropriates the Shiba Inu dog from the original Doge meme as its logo and namesake. With a satirical brand story, it built an internet following which exploded in numbers.

Now, before I get carried away creating memes, large online communities are extremely valuable to brands because they form the basis of new markets—or even provide the customers and crowdfunded capital for those markets. For Dogecoin, its community is based mostly on Reddit and Discord. The fact that Dogecoin occupies a good amount of mindspace in the online crypto communities is testament to this. Despite the frivolous nature of Dogecoin, having a mutual relationship with the internet community proves the social nature of this cryptocurrency and by extension, brands. The content-sharing nature of the internet amounts to a springboard of viral growth and even stronger digital brand presence. Much more so when there’s the undisputed Dogecoin brand champion, Elon Musk, with his self-appointed title ‘Dogefather’.

Elon Musk is known for dropping cryptic tweets to build a bullish investor sentiment around Dogecoin, making use of his 57 million Twitter followers (as of time of writing). Some are quick to call him out for blatant market manipulation, with what they call a pump-and-dump scheme. Could he be the next Wolf of Wall Street? Or rather, the Doge of Dogecoin-on-the-Moon? Like it or not, the influential cult figure Elon Musk is doing a darn good job as a brand champion of Dogecoin. What we can take away is that every brand needs a champion to be the face and personality to make it work. Dogecoin was just waiting for the right joker to come along.

Alas, Dogecoin is no more than a joke. Good if you happen to make a quick buck out of it. Not so much if you’re dumping your savings there and hoping to strike gold. (I’m not a financial advisor so please don’t take my word for it).

Hodl Up…

That’s no typo. That’s an intentional misspelling of ‘hold’ from the ‘buy-and-hold’ investment strategy in the context of crypto-investing. It’s now a backronym for ‘Hold On for Dear Life’, and part of the wider crypto lingo and acronyms that are exclusive to retail investors hot on this alternative investment asset.

Just some advice to put lambo on the moon:

Ignore FUD so you are not a weak hand, don’t FOMO, DYOR, BTFD.

All these crypto lingo parallels branding as brand language. Brand language is a part of verbal brand identity, the words, phrases and terms exclusive to a brand when referencing its products and services. This is instrumental in marketing to help consumers connect specific words or ideas to specific brands. At a deeper level, it builds a common language with existing consumers just like how the cryptocommunities use their crypto lingo in discussions. After all, it’s never about a brand-to-consumer relationship, but also a consumer-to-consumer (C2C) level that strengthens their affinity for said brand.