Recessions are normal, albeit unpleasant part and parcel of the business cycle. Peak and lull periods of economic activity in the wider lens of the world affects small and medium enterprises, potentially putting their balance sheets in the red. How could you optimise branding and marketing in the face of an economic downturn? But more importantly, how do these seemingly-ancillary areas sit with the core of what your business is great at?

Branding VS Marketing

First off, branding is a delicately crafted impression of where your company, product or service stand out amongst competitors. Marketing, in comparison, are merely the tactics deployed that hinge upon industry and cultural trends. These tactics should stay true to the core of your brand strategy. While marketing strategies evolve over time, branding remains consistent.

Build better brand relationships

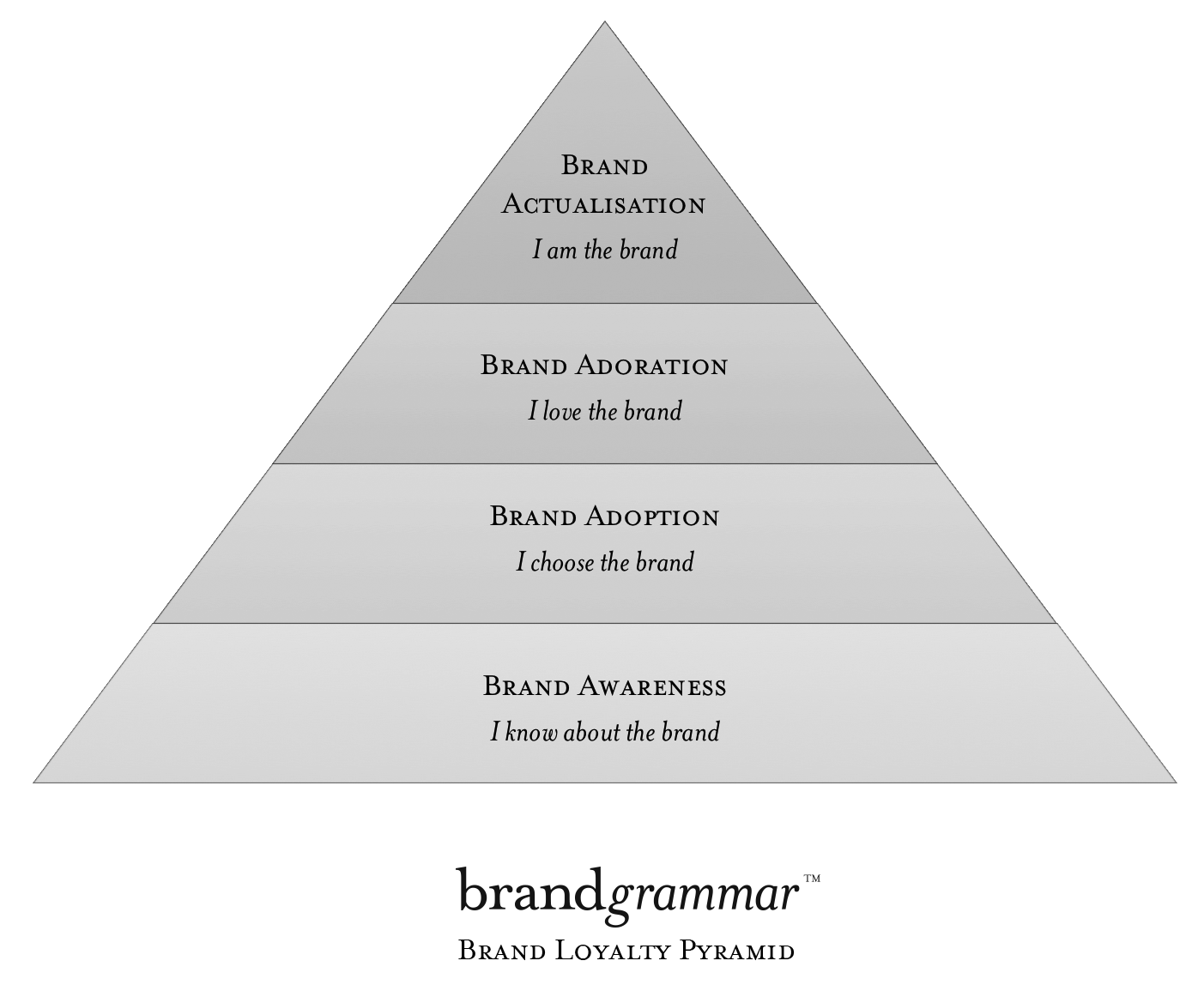

With that out of the way, let’s begin from the best-case scenario of the consumers’ brand loyalty. Brand engagement is understood to be an ongoing process with the consumer, a well-maintained relationship beyond the first buy-in/point of purchase. Through uncertain times, only the most brand-loyal of consumers will commit to the brand they know and love. At the same time, the main bulk of the existing consumer base is volatile to change what they want and willingly afford, to where they shop or not shop at all.

This slump period is a brilliant opportunity to find out what consumers think, feel and do, especially the loyal customer base (Brand Adoption and above in the Brand Loyalty Pyramid) that has been the source of a brand’s profitability. More than ever, aim to get close to prospective consumers and the existing buy-in base. With a widespread drop in spending typical of recessions, sales growth can no longer be the sole metric of success in marketing moves. Instead, brand engagement and social media reach/impressions are key.

Even without an in-house marketing team, the good news is that you can pick up the basics or involve partners to assist in building better brand relations with your customers. The end goal here is to derive an appropriate strategy based upon the data-driven insights.

Review all expenditures

From a business owner’s standpoint, the pressure is on to eliminate any expenses that are deemed ‘unnecessary’. Realistically, this refers to anything and everything not part of the overhead costs.

Do otherwise.

Lull periods are already bad for business, when what you do best is unable to rope in enough to stay afloat sometimes. Take this chance to review if your in-house marketing team can do more with less (budget). Yes it is easier said than done, but reviewing budget allocations allow for an organisation to navigate better through uncharted waters. A budget review does not imply reducing everything, but reallocating funds to wherever needs it most. Interestingly, fortune does favour the bold – forty years of evidence prove that those willing to invest wisely during a recession have, on average, struck gold more than those who cut back.

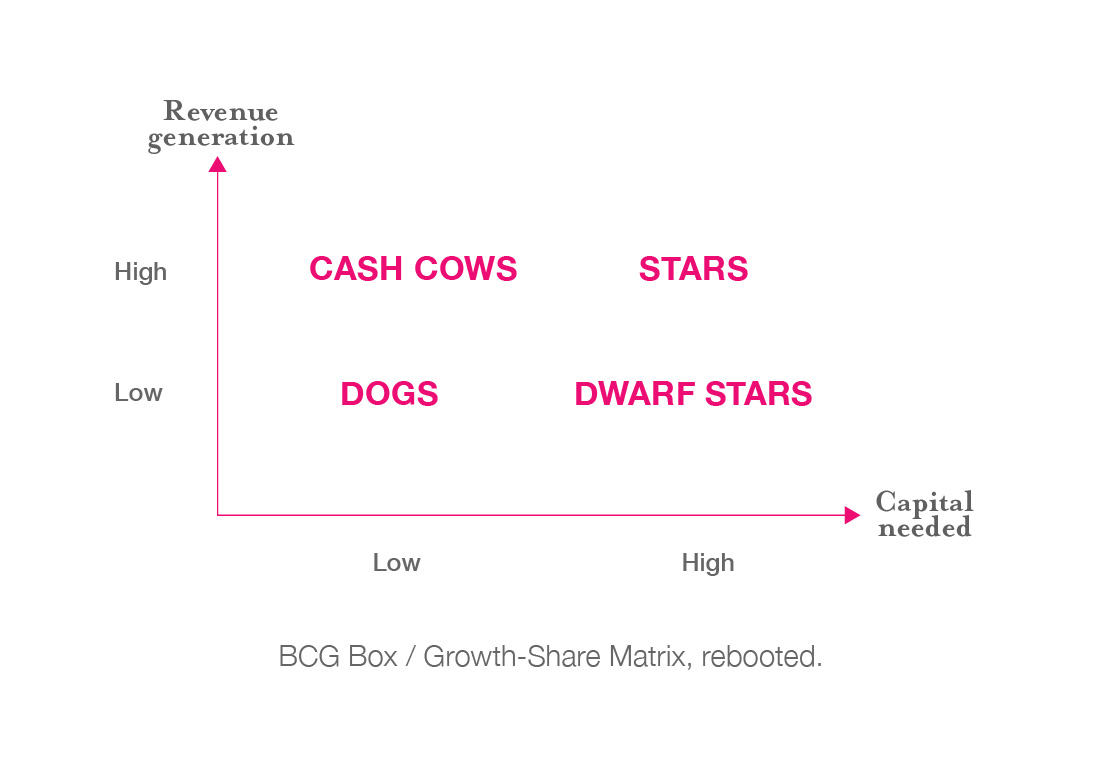

The Boston Consulting Group (BCG) devised a method for assessing the value of investments in a company’s portfolio in the 1970s. Fast forward half a century, we use this BCG Box (also known as the Growth-Share Matrix) as a guide in context of annual budget allocations.

Cash cows bring in much of the organisation’s revenue, requiring minimal funds to be pumped into them to operate. Typically, cash cows are the core offerings of your organisation. Keep milking them but ensure they do not become stars. Stars bring in high revenues but guzzle funds readily, leaving a thin profit margin. Stars tend to be well-performing project expansions requiring higher initial capital. Dogs are an interesting expenditure; they rope in small amounts of revenue with low maintenance in terms of cost. As such, it is ideal to liquidate them unless they could be developed into stars or even better, cash cows.

The original BCG Box describes the last category as ‘Question Marks’. As an investment, they have high growth potential but a low share of the market (i.e low turnover). Quite aptly, Question Marks are dilemmas between continued investment in hopes of turning it into a star or eliminating it entirely.

For our context, we shall term this Dwarf Stars instead. Dwarf Stars drain a significant portion of funds while bringing back low to negative ROI. Despite being almost a no-brainer to rid of them, Dwarf Stars usually serve a non-monetary benefit. This is not discounting the possibility that it could be grown into a Star or Cash cow. An example of a Dwarf Star is certainly dependent on your organisation’s industry – Occasions when a project blurs the line between work and a ‘favour for a friend’, how would you do it below industry rate while delivering a sort of minimum viable product? Your balance sheet has to compromise, unfortunately.

Again, the original BCG Box was intended to assess investment value in a portfolio. To frame it for a budget review purpose is simply a guide. Understandably, categorising the expenditures into these 4 categories is not without flaws. The expenditures may gradually shift between categories in a dynamic way.

Fine-tune brand and product offerings

Within a brand architecture, a brand and its sub-brand(s) always need to be well differentiated and managed based on their prospects. A known move by luxury brands are its sub-brands with lower price points, while carefully delivering on its overall brand promise.

When Armani comes to mind, haute couture Giorgio Armani tops the range with bespoke customisation.

Subsequently, Emporio Armani followed by Armani Exchange captures the market segment who buys into the Armani brand, albeit towards the high street fashion style.

During slow growth, sub-brands with more economical price points pick up the slack and help maintain overall brand performance. With multiple sub-brands, comes the need to carefully manage a company portfolio with clear differentiation so as to prevent consumer confusion. At times, it may be worth getting a branding partner on board so the business owner focuses on what they do best instead.

The economic slump presents a lull year ahead, but opportunists will see it as preparation time for a stronger rebound to leave others in the dust. Question is, which one are you?